The general ledger’s account balances are used to prepare the trial balance, ensuring all debits equal all credits. A chart of accounts (also called a CoA) is like a financial filing system for businesses. Essentially, it’s the framework for all of the financial accounts, organizing and classifying transactions.It works hand-in-hand with the GL, which actually records the transactions. A journal entry is a sequential list of accounting entries recording transactions while a GL is a formalized account system where recorded transactions in a journal are posted. In the following article, we will explore more about general ledger accounting, and how you can use FreshBooks software to simplify your bookkeeping as you track your company’s finances.

- You’ll be able to track inventory and suppliers and monitor anything else that can help you make informed decisions.

- However, reconciling individual account balances becomes extremely easy with online accounting software like QuickBooks.

- Imagine a vast, organized library where every book represents a financial transaction of a business.

- In financial accounting, a company’s main accounting record is its general ledger.

- You need to record business transactions in your books of accounts based on the dual aspect of accounting.

- Account balances represent the overall value in an account, calculating the debits and credits at any given time.When looking at account balances, you might hear the terms debit balance and credit balance.

What is your current financial priority?

You reconcile a general ledger by comparing its accounts with external records, correcting discrepancies to ensure accuracy. Non-operating expenses are your business expenses that aren’t related to your core operations. Think of interest payments or one-time losses that could be a result of missing or overcharged inventory. Operating expense accounts document every cost that’s needed for running your business. Things like payroll, rent, and depreciation are types of operating expense accounts. The following are the steps to a proper general ledger accounts reconciliation in detail.

Record All Financial Transactions

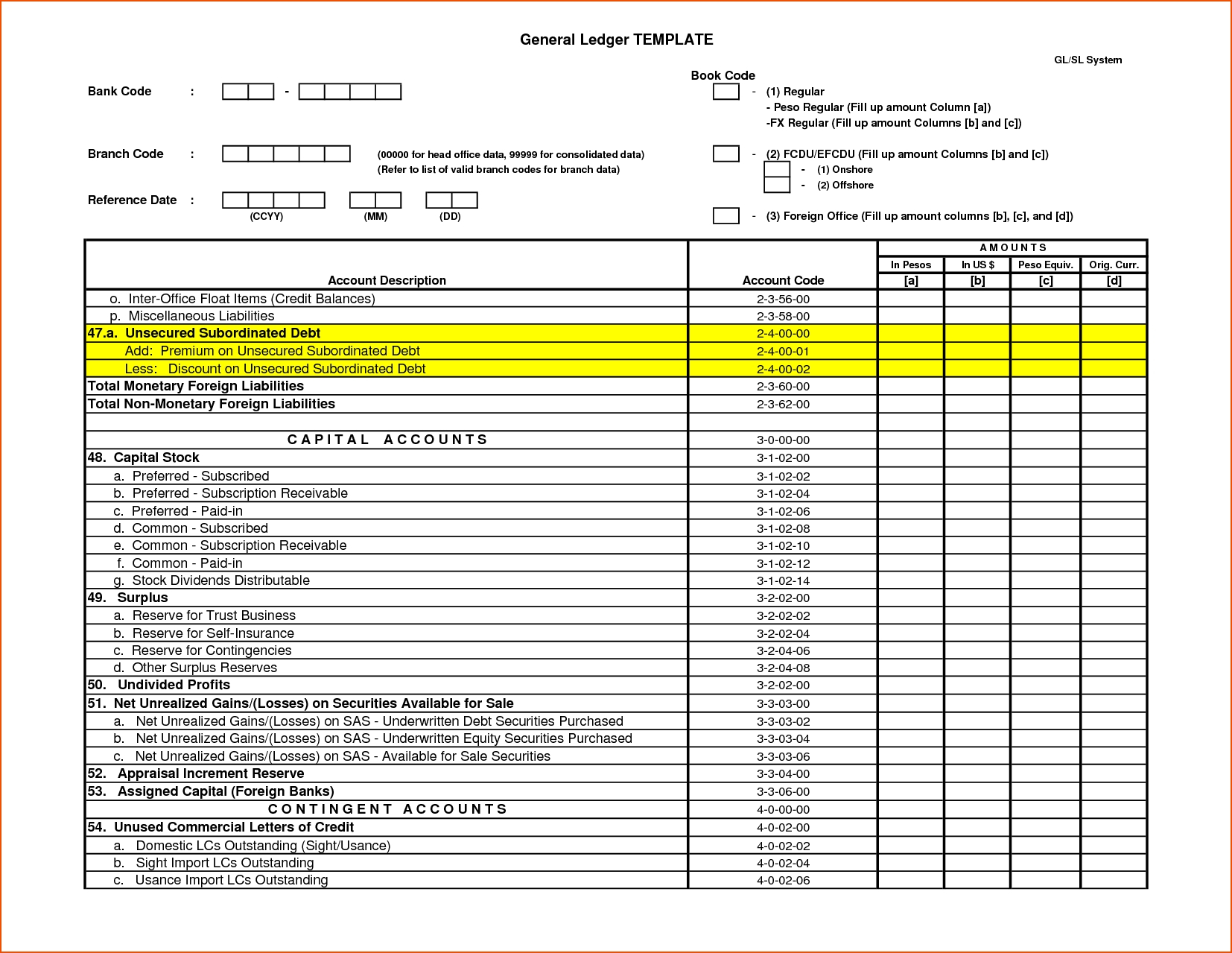

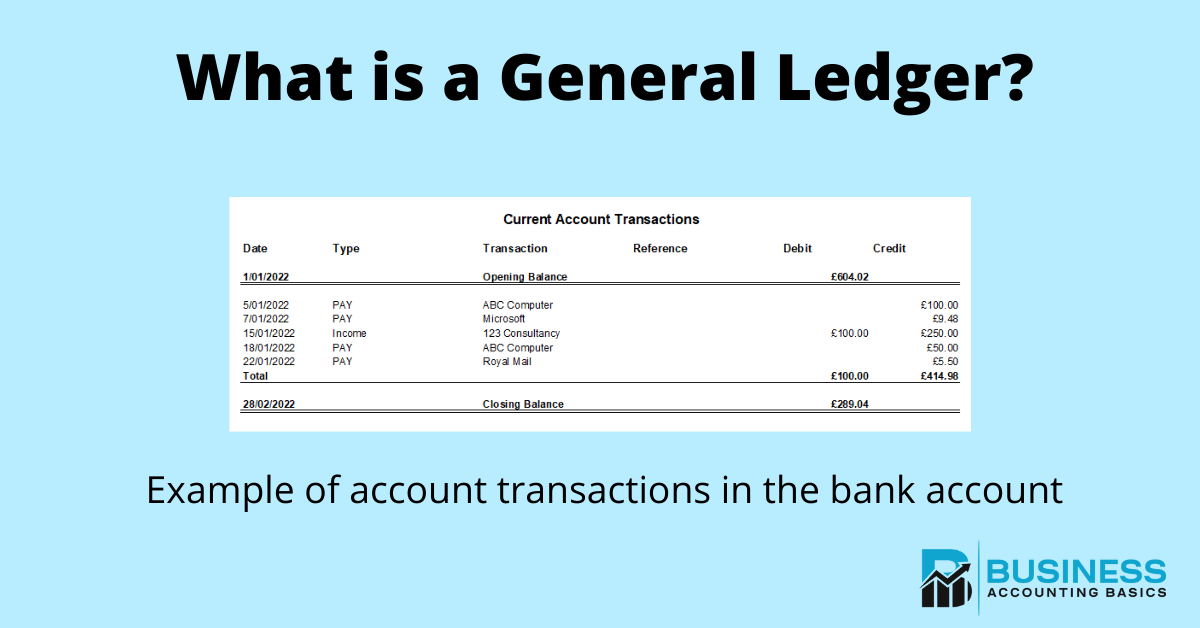

You can use the account balances in the general ledger to generate the trial balance, which lists every account and the current account balance. The dollar amount of total debits must equal total credits in the double-entry accounting system. As you can see, columns are used for the account numbers, account titles, and debit or credit balances. The debit and credit format makes the ledger look similar to a trial balance. Other ledger formats list individual transaction details along with account balances. If bookkeeping and accounting are done correctly, the sum of the trial balance’s debit side and credit side will match.

Does a general ledger use double-entry bookkeeping?

Specify the ledger for the selected data access set.Ledger is required for all general ledger reports. Enter the data access set that you can access basedon the defined security structure. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For example, when furniture is bought on credit for $4,000 from Fine Furniture Co., we will need to make an entry of $4,000 on the debit side of the furniture account (i.e., because this asset is increasing). An important point to note is that the treatment for assets is exactly the opposite of the treatment for liabilities and capital. If he introduces any additional capital, an entry will be made on the credit side of his capital account.

All of those transactions are then transferred into your “master notebook,” which—you guessed it—is your general ledger.Here are a few examples of the types of general ledger accounts. To reconcile your GL at the end of each fiscal period, you must sales returns and allowances recording returns in your books generate a trial balance by totaling all of the debit and credit accounts and then checking to verify that the debits are equal to the credits. If these are not equal, then the accountant will check for errors in the journals and accounts.

For example, if you are a small business owner and need to file Form 1099 for a contractor you hired this year, then you need to know how much you paid them during the year. In this case, you can quickly check the payment invoices recorded in the general ledger to fill out this form correctly. With the help of a general ledger, you can better track and evaluate every transaction for your business. But of course, that’s easier said than done—which is why we’ve drawn out exactly how general ledgers can be used to your benefit. Of course, your general ledger’s appearance will ultimately depend on your personal preference and choice of software.

When a company buys something from a vendor, it typically doesn’t pay for it immediately. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

However, there is always the chance that something gets misreported—like if you’re paying with petty cash and don’t record a $5 purchase. Nick Gallo is a Certified Public Accountant and content marketer for the financial industry. He has been an auditor of international companies and a tax strategist for real estate investors. He now writes articles on personal and corporate finance, accounting and tax matters, and entrepreneurship. Apply for financing, track your business cashflow, and more with a single lendio account. A general ledger code is a unique identifier for each account in the general ledger, used to categorize transactions.

The first thing you—or your accountant—must do is gather the accounting documents that are used to post corresponding entries. If you’re creating a general ledger for the month of May, then all receipts and invoices from May must be recorded to ensure there are no missing entries. Profit and loss accounts—or income statements—are known to be temporary accounts. Typically, all transactions are initially recorded in the general journal, and then all the related accounts are transferred to the general ledger. Here’s an example of a journal entry to record the purchase of $500 of office supplies using the funds in your cash account. The general ledger is typically updated regularly, often daily, to ensure accurate and up-to-date financial records.

Since the general ledger is an overview of every financial transaction, it is easy to see every entry made and identify unusual activity. Basically, where your general ledger contains the summary-level information, the sub-ledgers contain the details, such as transaction dates, amounts paid, and descriptive information. A sub-ledger gives you a place outside of the general ledger to record detailed information on your transactions. This guide will give you the information you need to interpret it, including what details it contains, its role in the double-entry accounting system, and some practical examples of how it works. Blockchain is a type of decentralized ledger technology (DLT) that securely records transactions across a network of computers.

Where once all journal entries and general ledger accounts were manually recorded by hand, now technology can automate the accounting process. Quality accounting systems have become a staple for small businesses everywhere, as they are essential to the management of accounts and organized record keeping. An accounting ledger is part of the bookkeeping system and is used by businesses to record all their financial transactions. Businesses will create separate categories for such transactions, which are known as accounts. All account records of a company will be listed and contained within the general ledger, or principal book of accounts. Financial statements, such as income statements, balance sheets, and cash flow statements, show the financial health of a business.